Page 79 - Muzaffargarh Gazzetteer

P. 79

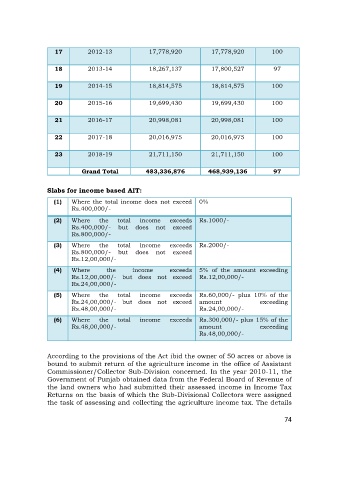

17 2012-13 17,778,920 17,778,920 100

18 2013-14 18,267,137 17,800,527 97

19 2014-15 18,814,575 18,814,575 100

20 2015-16 19,699,430 19,699,430 100

21 2016-17 20,998,081 20,998,081 100

22 2017-18 20,016,975 20,016,975 100

23 2018-19 21,711,150 21,711,150 100

Grand Total 483,336,876 468,939,136 97

Slabs for income based AIT:

(1) Where the total income does not exceed 0%

Rs.400,000/-

(2) Where the total income exceeds Rs.1000/-

Rs.400,000/- but does not exceed

Rs.800,000/-

(3) Where the total income exceeds Rs.2000/-

Rs.800,000/- but does not exceed

Rs.12,00,000/-

(4) Where the income exceeds 5% of the amount exceeding

Rs.12,00,000/- but does not exceed Rs.12,00,000/-

Rs.24,00,000/-

(5) Where the total income exceeds Rs.60,000/- plus 10% of the

Rs.24,00,000/- but does not exceed amount exceeding

Rs.48,00,000/- Rs.24,00,000/-

(6) Where the total income exceeds Rs.300,000/- plus 15% of the

Rs.48,00,000/- amount exceeding

Rs.48,00,000/-

According to the provisions of the Act ibid the owner of 50 acres or above is

bound to submit return of the agriculture income in the office of Assistant

Commissioner/Collector Sub-Division concerned. In the year 2010-11, the

Government of Punjab obtained data from the Federal Board of Revenue of

the land owners who had submitted their assessed income in Income Tax

Returns on the basis of which the Sub-Divisional Collectors were assigned

the task of assessing and collecting the agriculture income tax. The details

74