Page 74 - Muzaffargarh Gazzetteer

P. 74

Thal Project a special assessment in Layyah and Kot Addu Tehsils of

Muzaffargarh District was made by the Government with effect from Kharif

1952 for a period of 10 years vide Punjab Government memo. No. 3848/54-

10 dated July 2, 1954. All areas irrigated by the Thal Canal in the above

mentioned two tehsils of the district were assessed to land revenue and

malikana in the manner indicated below:

(1) All crown waste lands not previously assessed to land revenue at Rs. 2/-

per matured acre on each harvest.

(2) All crown waste lands already assessed to land revenue were required to

continue to pay the assessment but when the same was allotted, the allottee

was required to pay a special malikana equal to the difference.

(3) The proprietary land acquired by the Thal Development Authority and

then re-allotted was treated as (2) above with the only difference that special

malikana of it would go to the TDA and not to the Government.

(4) All such allotted land was required to pay in addition, a general malikana

at Re. 1/- per allotted acre per harvest. The amount of malikana realized in

respect of land acquired by the TDA was to go to its own funds, while the

amount in respect of the crown land was to be credited to the provincial

revenue.

(5) Proprietary land allotted to the old proprietors by the TDA as

compensatory grants being the area left with them by the TDA as a result of

its acquisition proceedings were required to pay the same land revenue as

before even if they received irrigation. These lands were exempted from the

payment of any malikana whether general or special.

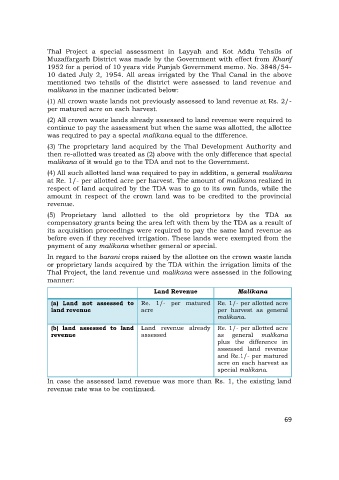

In regard to the barani crops raised by the allottee on the crown waste lands

or proprietary lands acquired by the TDA within the irrigation limits of the

Thal Project, the land revenue und malikana were assessed in the following

manner:

Land Revenue Malikana

(a) Land not assessed to Re. 1/- per matured Re. 1/- per allotted acre

land revenue acre per harvest as general

malikana.

(b) land assessed to land Land revenue already Re. 1/- per allotted acre

revenue assessed as general malikana

plus the difference in

assessed land revenue

and Re.1/- per matured

acre on each harvest as

special malikana.

In case the assessed land revenue was more than Rs. 1, the existing land

revenue rate was to be continued.

69